Would Atlanta and Fulton County need to raise property taxes on its residents and small businesses if it valued skyscrapers and data centers closer in line with the free market and developer promises?

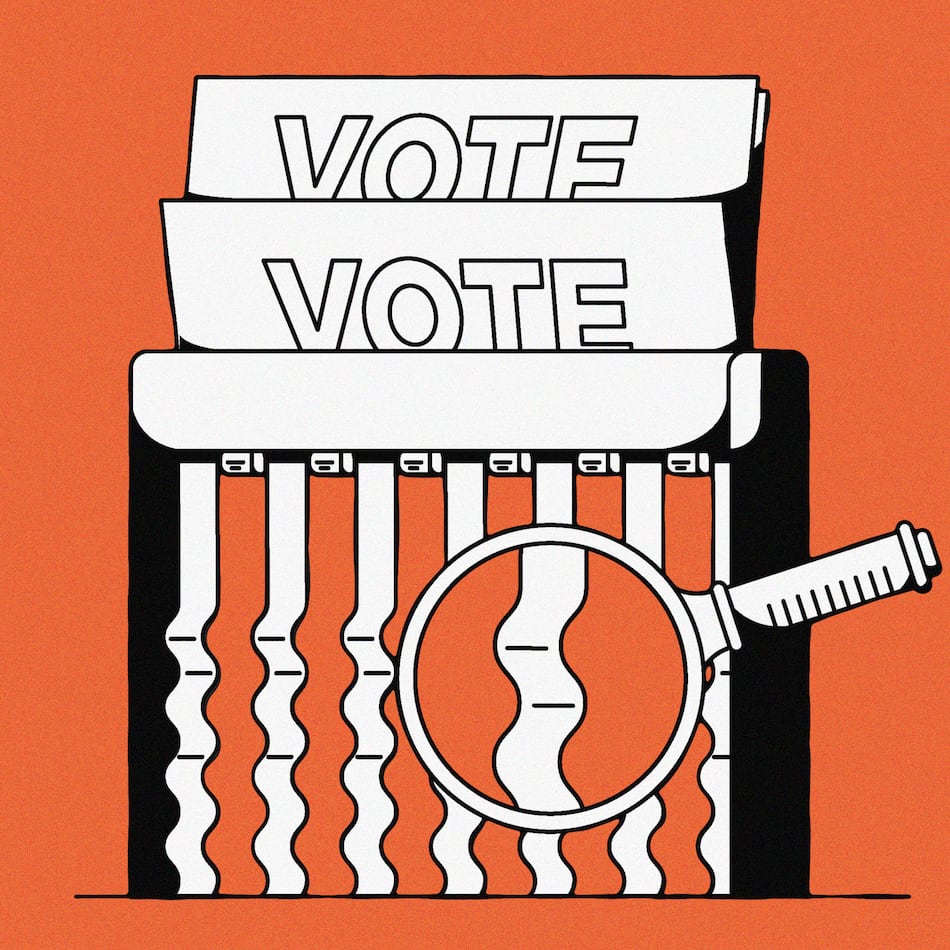

That’s a question raised by several residents who argue that Fulton officials routinely undervalue commercial properties, leaving homeowners to pick up an oversized tax burden.

“How are you asking us for more money when you’re not making billionaires in this city pay what they owe?” community activist Devin Barrington-Ward told the Fulton County Board of Commissioners at a Wednesday meeting.

Those sentiments dominated discussion at Fulton’s first public hearing to discuss raising its millage rate, the measurement used to calculate property tax bills.

The seven-member Board of Commissioners announced last month they plan to increase property taxes by nearly 12.5% to balance the budget. If implemented, it would increase the county’s property tax revenue by nearly $79 million.

Commissioner Mo Ivory, who represents District 4, including downtown and Midtown Atlanta, said higher taxes are needed to increase much-requested government services. She said “spreading out the cost of raising the millage rate amongst all property owners” is the best solution.

Credit: Alex Acosta

Credit: Alex Acosta

Many residents who spoke Wednesday, however, disagreed and pointed to some of Atlanta’s best-known development projects as proof.

The Atlanta Journal-Constitution and Channel 2 Action News in 2018 published a joint investigation that found commercial properties were routinely being sold for significantly more than their government-assigned value.

A 2023 study by Georgia Tech’s School of Public Policy found Atlanta and Fulton County are missing out on $290 million each year because of undervalued commercial properties. Former Invest Atlanta board member Julian Bene argues the figure could be even higher.

“We would not need to hit residents with higher taxes — beyond what property value inflation wreaks — if we had honest and competent appraisal of trophy commercial (properties),” Bene told the AJC.

Bene and others pointed to multiple buildings that have been sold in recent years for more than double the county’s appraised value.

Examples include 725 Ponce that sold for $300 million in 2021 and is now appraised for only $130 million; and 1180 Peachtree tower, which sold for $465 million in 2022 but is appraised at $187 million.

The Fulton County Board of Assessors, which is in charge of property appraisals, did not immediately respond to requests for comment.

Credit: Courtesy Cousins Properties

Credit: Courtesy Cousins Properties

Proven track record

This isn’t the first high-profile debate over Atlanta commercial property values and whether they’re being assessed properly.

In 2018, the AJC and Channel 2 analyzed 264 multimillion dollar commercial property sales from 2015 to 2018 and found about two-thirds sold for at least 50% more than the county said they were worth that same year. Of those, 119 properties sold for more than double their assessed value.

Those findings were confirmed by a subsequent county audit and analysis by the city of Atlanta. Fulton County chief appraisers have long denied there are systematic flaws in commercial property assessments.

Roderick Conley, the current chief appraiser, told residents in a February 2024 board of assessors meeting county assessments take four years of sales data into account, while private assessors may only look at months of data to calculate market values, and that single sales might not represent the total market.

Credit: JOHN SPINK / AJC

Credit: JOHN SPINK / AJC

Several commercial properties have also been granted tax breaks by development authorities that temporarily deflate their assessed values to produce tax savings — a common incentive intended to recruit economic development projects. Those incentives are often contentious and were another point of conflict Wednesday.

“I’m sure Elon Musk appreciates the $10 million tax break … but I do not,” resident Jim Martin told commissioners, referencing a controversial 2024 data center tax break granted to social media platform X, which Musk owns.

Pandemic shake-up

The past few years have been a roller coaster for commercial real estate in large part because of the aftermath of the COVID-19 pandemic.

The 2020 shutdown and travel restrictions froze the hospitality market, spurring multiple hotel foreclosures. The office market was also upended with the widespread popularization of remote and hybrid work schedules which saw companies reevaluate their workplace leases.

About a third of Atlanta’s office square footage is either vacant or available to rent, according to real estate services firm CBRE.

Most of those struggles are concentrated in older and less desirable buildings, which are often classified as Class B or C office space. About a quarter of all securitized debt backed by office properties is delinquent in metro Atlanta, meaning its owner has missed at least two payments, according to data firm Trepp.

Several buildings in Atlanta have gone through distressed sales or foreclosure at steep discounts compared to their last sale — and sometimes below their assessed value. Bene, however, argues those struggles at the bottom of the market don’t justify undervaluing properties that are thriving.

“Instead of fixing the trophy under-appraisal scandal, the county and city are now proposing to raise the property tax rate on homes and small businesses,” Bene said.

Credit: Daniel Varnado/For the Atlanta Journal-Constitution

Credit: Daniel Varnado/For the Atlanta Journal-Constitution

He points to developments like the QTS data center campus in west Atlanta, Ponce City Market and Midtown Union, which promised billion-dollar-plus investments but are appraised by the county at a fraction of that value. The owners of those buildings did not respond to requests for comment.

Fulton County will hold a second public hearing Aug. 6, before commissioners hold a final vote later that day.

About the Author

Keep Reading

The Latest

Featured