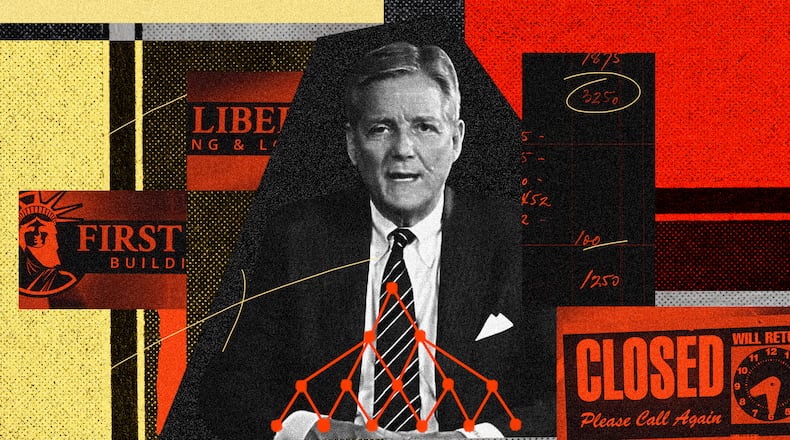

Federal securities regulators contend the politically connected lender First Liberty Building & Loan operated a $140 million Ponzi scheme.

So far, the team appointed by a judge to recoup money for jilted investors has seized control of more than $1.6 million in assets, and signaled in a court filing it is preparing for a lengthy battle to recover additional funds.

S. Gregory Hays, a court-appointed receiver, outlined the messy state of affairs following the June collapse of First Liberty, a lender that sold investors on “loan participations” offering outsize returns.

On Thursday, Hays wrote in a quarterly report that the receivership is in possession of roughly 60 loans issued by First Liberty.

None of those loans made by the Newnan-based firm are current and many borrowers are resisting payment. But his team is scrutinizing the “improper use” of the money and will seek to recoup the funds.

“The Receiver anticipates that collecting these loans will be an expensive and protracted process which will take many months and may require protracted litigation,” the court filing says.

Credit: arvin.temkar@ajc.com

Credit: arvin.temkar@ajc.com

First Liberty and its founder, Brant Frost IV, were deeply embedded in conservative politics, and the firm aggressively marketed to a GOP-friendly audience.

Promotional materials highlighted appearances on the “Hugh Hewitt Show” and advertisements on the “Erick Erickson Show.”

More than $300,000 in political and charitable contributions connected to First Liberty and the Frost family have already been voluntarily returned, according to the report filed this week.

But that’s only a fraction of the nearly $1.5 million in donations tied to the family and its companies that flowed largely to Republican candidates, party organizations and conservative causes tallied in an Atlanta Journal-Constitution analysis.

The report offers more details on the downfall of First Liberty. Frost IV was accused in a lawsuit by the U.S. Securities and Exchange Commission earlier this year of orchestrating what authorities say was a sprawling Ponzi scheme.

The receiver in the filing outlined several loans backed by certain borrower guarantees or other collateral that he could seek to recoup for investors.

“While most of the loans have been in default for a long time, the Receiver’s impression is, frankly, that many of the borrowers are using the Receivership as a basis to contest their loans and to avoid their responsibilities to repay those (loans),” the filing said.

Credit: arvin.temkar@ajc.com

Credit: arvin.temkar@ajc.com

“Investors should be assured that the Receiver intends to enforce each loan to the fullest extent possible and default interest is accruing,” the filing said.

Frost IV has apologized and urged victims to cooperate with the receiver’s efforts to recover funds. His son, Brant Frost V, isn’t named in the SEC complaint. But he is also facing scrutiny.

The Georgia Republican Assembly PAC that Frost V led is accused of 61 violations by the state ethics commission, which says the group illegally influenced elections with more than $220,000 in unreported expenditures.

And Secretary of State Brad Raffensperger’s office subpoenaed Frost V for documents tied to a new lending firm he sought to incorporate just before First Liberty’s collapse. Raffensperger has cited the probe to press the Legislature for expanded powers to crack down on financial fraud.

Frost V has declined repeated requests for comment, including after he was elected to a Coweta County GOP party post in August. Records show he was recently licensed as an insurance agent and launched a new firm under the name “E.B. Frost.”

Hays cautioned in the report that recovering money for victims will “be an expensive and protracted process which will take many months and may require protracted litigation.”

But he said authorities are committed to pursuing repayment and clawing back funds where possible.

“Investors should be assured that the Receiver intends to enforce each loan to the fullest extent possible and default interest is accruing,” the filing said.

The receiver also said he is working to launch a claims process before the end of the year.

Keep Reading

The Latest

Featured